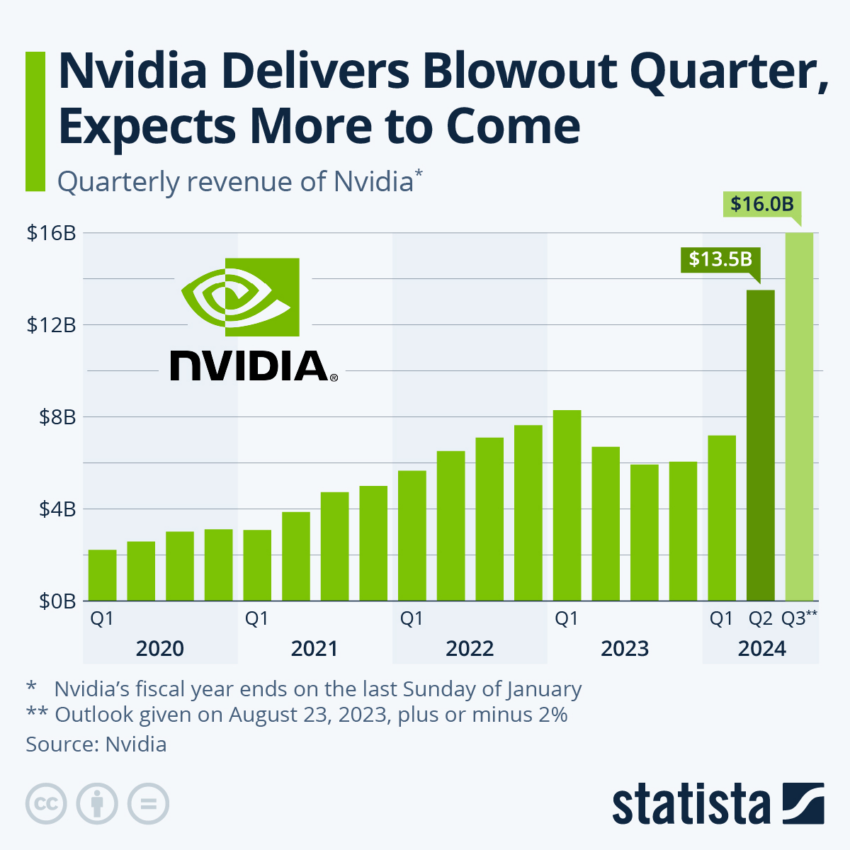

Nvidia posted an impressive 211% year-over-year growth rate, and the entire tech industry cheered. Many people were surprised by this growth spurt, largely due to the growing demand for AI – particularly generative AI like ChatGPT, and image generation services like Midjourney

However, not all industry insiders share this bullish sentiment. One of them is Samantha LaDuke, who closely follows Nvidia’s financial activities. LaDuke questioned the company’s latest second quarter results. She also highlighted concerns about the company’s “questionable” growth in data center revenue.

Skepticism over Nvidia’s quarterly results

One of the controversies that drew attention to Nvidia was a $2.3 billion line of credit to specialized cloud provider CoreWeave. BlackRock, one of the main lenders, is also Nvidia’s third-largest shareholder, owning more than 115.6 million shares.

“We negotiated with them to determine a bail-in schedule, amortization schedule and repayment schedule. For us, asset-based leveraging is a cost-effective way to access the debt markets,” said Michael Intrator, CEO of CoreWeave.

What’s most intriguing about this credit facility is that Nvidia’s graphics processing units (GPUs) have been used as collateral, and the capital is intended to expand to meet the growing AI workload.

In addition, the $2.3 billion credit coincides with Nvidia’s Q2 data center revenue. The company reported a record $10.3 billion, up 141% from last quarter and up 171% from the same period last year.